-

Scottie Scheffler Tweaks Tour Schedule with Major Ramifications - 14 mins ago

-

Why were so many Thai farmers among the hostages held by Hamas? - 16 mins ago

-

Will the Santa Cruz Wharf be rebuilt after it broke apart? - 29 mins ago

-

Braves vs. Giants Highlights | MLB on FOX - 32 mins ago

-

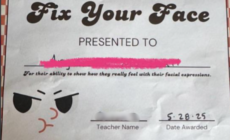

Teacher’s Award for Girl in Seventh Grade Sparks Debate: ‘Poor Kiddo’ - 56 mins ago

-

Democrats are busy bashing themselves. Needed, or just needy? - about 1 hour ago

-

Rangers vs. Nationals Highlights | MLB on FOX - about 1 hour ago

-

Unique Father’s Day gifts for tech dads, from laptops to pool cleaners - about 1 hour ago

-

When ‘Real Housewives’ Makes Women Want to Be More Than Housewives - 2 hours ago

-

The National Guard comes to Los Angeles: What’s going to happen? Is it legal? - 2 hours ago

Newsom: Homeowners should benefit from interest on insurance payouts

As Los Angeles reels from the devastation of the Palisades and Eaton fires, Gov. Gavin Newsom plans to sponsor a bill that would ensure that homeowners, not lenders, benefit from interest earned on insurance payouts for destroyed or damaged properties, according to his office.

“Homeowners rebuilding after a disaster need all the support they can get, including the interest earned on their insurance funds,” Newsom said in a statement announcing the planned bill.

The state bill will be authored by Assemblymember John Harabedian (D-Pasadena). A spokesperson for Newsom’s office said the bill is expected to be introduced by the end of the month.

Insurance payouts can accrue significant interest while the money sits in escrow during rebuilding, bill proponents say. California law already requires lenders to pay homeowners the interest on escrowed funds for property taxes and insurance but not for insurance payouts held in escrow, according to the governor’s office.

A spokesperson for Newsom’s office said that interest rates are typically about 2% annually, which would amount to roughly $20,000 a year for a $1-million payout for a destroyed home.

Source link