-

Yankees GM Warns Defense-Challenged $5.1 Million Rookie to ‘Earn’ Place on Team - 13 mins ago

-

Karla Sofía Gascón ‘contemplated the unthinkable’ amid social media scandal - 26 mins ago

-

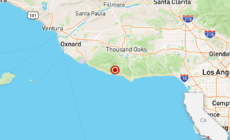

4.1 earthquake felt across Southern California, centered near Malibu - 35 mins ago

-

Villanova Wildcats vs. UConn Huskies Big East Tournament Highlights | FOX College Hoops - 37 mins ago

-

How to Watch Big Ten Championships: Live Stream College Wrestling, TV Channel - 53 mins ago

-

Rob Lowe said participating in sex scenes was required of him back in the day - about 1 hour ago

-

Cyclists hit by car while giving out immigration rights cards in Boyle Heights - about 1 hour ago

-

No. 8 Michigan State tops No. 17 Michigan, wins Big Ten title by three games - about 1 hour ago

-

Video of What Pup Does at Doggy Daycare Has Internet ‘Sobbing’ - 2 hours ago

-

Trans sex worker killed by LAPD after calling 911 to report kidnapping - 2 hours ago

Some economists think U.S. inflation is likely to rise in 2025

The Trump administration’s barrage of tariffs on key U.S. trading partners and ongoing crackdown on immigration is likely to result in higher prices for American consumers and businesses, according to Wall Street analysts.

Economists with Morgan Stanley Research said in a report on Friday that they expect inflation in 2025 to rise 2.5%, up from their previous forecast in December of 2.3%. Another key gauge that strips out volatile food and energy costs is now projected to reach 2.7%, up from 2.5% in the bank’s earlier forecast.

“We now see higher inflation in 2025 with a more pronounced and sooner re-acceleration in goods prices,” the analysts wrote.

“If our narrative entering the year was ‘slower growth, stickier inflation’ then we now think ‘slower growth, firmer inflation,'” they added.

Analysts at Goldman Sachs also said on Friday they’re now projecting higher inflation, largely due to Mr. Trump’s tariffs. Core PCE inflation, or price increases excluding food and energy costs, could rise to 3% this year, rather than sinking to 2.1% by year-end if there were no tariffs in place.

The cost of food, shelter and other items remains a top economic issue around the U.S., with the soaring cost of eggs becoming a national talking point. A recent CBS News poll found that 77% of Americans say their incomes aren’t keeping up with the pace of inflation.

Inflation soared to its highest level since 1981 during the pandemic, reaching a peak of 9.1% in June 2022. The pace of price increases has cooled since then, but costs remain roughly 10% higher than before the COVID crisis, Federal Reserve Bank of St. Louis data shows.

Recently, inflation has been moving in the wrong direction. After dipping to 2.4% in September, the closely watched Consumer Price Index has nosed up, and in January rose to an annual rate of 3% — higher than the Federal Reserve’s 2% target and the fourth straight monthly increase. The Commerce Department is scheduled to release CPI data for February on March 12.

Many businesses are also expecting higher prices. As of early February, manufacturers and service firms expected inflation over the next year of 3.5% and 4%, respectively, according to a Federal Reserve Bank of New York survey out this week. Companies pointed to stiffer U.S. tariffs on foreign imports, which raise their operating costs, as a major reason they’re bracing for higher inflation.

President Trump on Friday again suspended 25% tariffs on Canada and Mexico, the second time he has paused steeper levies on the two largest U.S. trade partners. The White House has also recently raised tariffs on China by an additional 10% and has vowed to deploy broader “reciprocal tariffs” against other nations on April 2.

Although the delays leave open the possibility of a breakthrough in trade talks, the whipsaw in policy makes it more challenging for businesses to plan in advance.

Tighter immigration restrictions can contribute to inflation by reducing the nation’s supply of labor, according to economists.

“One factor that we think limits services disinflation is reduced immigration, which could lead to labor shortages in many face-to-face service sectors (retail, restaurants, leisure, hospitals) that could result in supply-side driven inflation,” the Morgan Stanley analysts said in their report.

Persistent inflation could deter the Fed from moving to nudge down interest rates and lower borrowing costs for consumers and businesses, experts note. About 1 in 10 economists polled by FactSet expect the central bak to cut rates at its next meeting on March 19.

Source link