-

2026 World Cup: Shaboozey, FOX Sports kick off one year to go from soccer’s biggest event - 11 mins ago

-

‘How To Train Your Dragon’ Director Defends Live-Action Remake Changes - 17 mins ago

-

Photographer captures Sen. Alex Padilla’s takedown - 25 mins ago

-

Candace Cameron Bure, 49, shares tropical vacation photos in string bikini - 28 mins ago

-

GOP tax bill could cost low-income Americans $1,600 per year, CBO says - 33 mins ago

-

Brother of Air India plane crash survivor concerned for third sibling, missing presumed dead - 49 mins ago

-

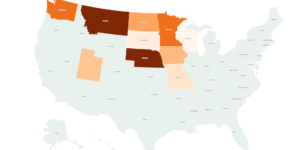

Map Shows 10 States Hit Hardest by Surge in Home Insurance Prices - 56 mins ago

-

Ranking the NFL’s best marriages between QBs and their teams - 58 mins ago

-

Dodger Stadium Express to run despite curfew restrictions - about 1 hour ago

-

Google, OpenAI, Spotify, other platforms experience outage, affecting tens of thousands of users - about 1 hour ago

IRS Issues Advice to Taxpayers Who Missed April 2025 Deadline

The Internal Revenue Service (IRS) has highlighted several options for Americans who missed the April 15, 2025, federal tax-filing deadline, advising those who have yet to file and pay should do so as soon as possible.

Why It Matters

Missing the filing deadline can trigger penalties, interest, and potential complications with future filings. The IRS announcement is important for anyone who may be facing late fees or seeking refunds.

What To Know

The IRS said taxpayers who owe taxes, interest, or penalties should file and pay promptly to limit additional financial consequences, according to official guidance issued on June 9, 2025. As interest and penalties accrue daily on unpaid taxes, filing promptly—even if unable to pay in full—can limit additional charges.

Multiple secure payment methods are available, including IRS Online Account, IRS Direct Pay, the Electronic Federal Tax Payment System (EFTPS), and major credit or debit cards. Immediate electronic payment confirmation is also provided.

Taxpayers unable to pay their full balance may apply for a payment plan online. Short-term plans are available for those who owe less than $100,000, granting up to 180 days to pay.

Long-term installment agreements, available for balances under $50,000, offer up to 72 months of monthly payments. While interest and penalties continue, active installment agreements reduce the failure-to-pay penalty by half.

Americans who requested a tax-filing extension have until October 15, 2025, to submit their returns, but any balance owed was still due by the original April deadline.

GETTY

Penalty Relief

The IRS directed taxpayers who receive penalty notices to review instructions for requesting relief. Those with a compliant filing and payment history in the past three years may be eligible for penalty abatement.

Other IRS Deadlines

In related guidance, the IRS reminded Americans with business, gig, or investment income not subject to withholding about the next estimated tax payment deadline on June 16, 2025.

Most employees pay their taxes on the annual deadline every April, but freelancers, gig workers, small business owners and anyone else earning money that hasn’t been subject to federal withholdings may have to submit quarterly payments four times a year. This deadline applies for income earned between April 1 and May 31.

June 16 is also the deadline by which Americans living and working abroad should file and pay any taxes owed. The extension applies to U.S. citizens and resident migrants outside the country, including dual citizens, offering them a two-month grace period after the regular April 15 deadline.

What Happens Next

The IRS will continue accepting 2024 federal tax returns and payments.

Taxpayers expecting a refund who have yet to file will not receive penalties, but should submit returns so they can receive any owed money.

Source link