-

Cowboys Coach Hopeful About Micah Parsons’ Future in Dallas - 8 mins ago

-

Padma Lakshmi, 54, sizzles in hot pink bikini beach photos on Instagram - 10 mins ago

-

William Byron and more post-race interviews from Iowa Speedway | NASCAR on FOX - 20 mins ago

-

How to Watch Seattle Sounders vs Santos Laguna: Live Stream Leagues Cup, TV Channel - 47 mins ago

-

FINAL LAPS: William Byron takes the checkered flag at the Iowa Corn 350 | NASCAR on FOX - about 1 hour ago

-

Tom Brady says Scottie Scheffler is still learning to ‘make sense of success’ - about 1 hour ago

-

William Byron and more post-race interviews from Iowa Speedway | NASCAR on FOX - 2 hours ago

-

Woman charged after toddler is found in suitcase in New Zealand bus’ luggage compartment - 2 hours ago

-

Desperate Braves Urged To Target Struggling NL Hurler In Free Agency - 2 hours ago

-

White Sox vs. Angels Highlights | MLB on FOX - 2 hours ago

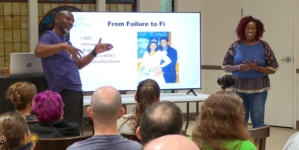

The father of the 401(k)

In 1981, Ted Benna created the first 401(k) plan, which allowed corporations to contribute, tax-free, to workers’ retirement accounts. That allowed companies to get out of the pension business, but gave employees more responsibility over their retirement funds. “Sunday Morning” contributor Kelefa Sanneh talks with Benna about how an obscure tax-code provision led to our current financial planning for retirement (and, at a time of precipitous stock market shocks, more angst).

Source link