“Between 2010 and 2025, the government withdrew approximately HUF 15 trillion (EUR 39.47 billion; 1 EUR = 380 HUF) in surplus funds from international capital,” the Prime Minister’s Political Director announced on his social media page on Sunday.

Balázs Orbán pointed out that the amounts collected from banks, energy companies, retail chains, telecommunications and pharmaceutical companies through special taxes, extra profit taxes and targeted payment obligations served directly or indirectly to protect the population and domestic businesses.

One of the sharpest dividing lines between the nationalist and left-wing economic policies is the question of how much global capital should be involved in public burden sharing and who should bear the burden of crises: Hungarian families or large international companies generating outstanding profits, the politician said.

Based on his presentation, in the banking sector,

the bank tax that was introduced in 2010, generated hundreds of billions of forints annually.

The transaction tax also generates hundreds of billions of forints in revenue annually. The extra profit tax on banks introduced in 2022 provided another significant source of revenue. The settlement of foreign currency loans, the exchange rate cap, the preferential final repayment, and the National Asset Management Program stabilized the housing situation of more than 35,000 families. The credit moratorium between 2020 and 2022 left thousands of billions of forints in immediate liquidity with households and businesses, he said.

In the energy sector, the “Robin Hood” tax and the extra profit tax levied on the price difference between Ural and Brent oils ensured the sustainability of the utility price protection system and the financing of the fuel price cap between November 2021 and December 2022, wrote the Prime Minister’s Political Director.

Balázs Orbán added that the retail tax represents a significant contribution to the budget.

Price caps, mandatory promotions, and margin reductions had a direct price-suppressing effect on dozens of basic food items during the period of inflation.

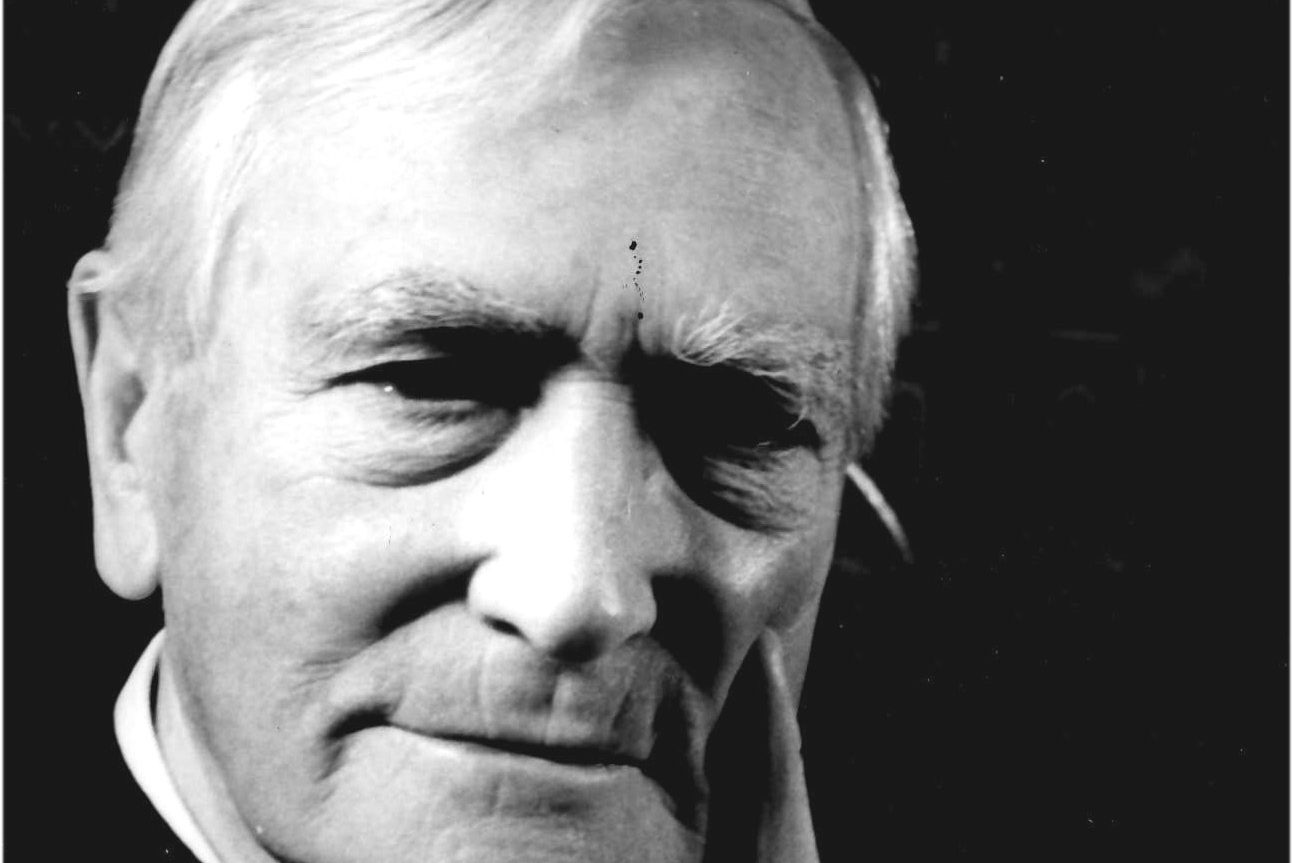

Photo: Facebook/Orbán Balázs

In the telecommunications sector, the per-minute telecommunications tax and the extra profit tax between 2022 and 2024 provided additional resources. The estimated impact of the voluntary price cap for 2025-2026 is a savings of around HUF 41 billion for households, he said. He added that the special tax on pharmaceutical manufacturers and the payment obligation of pharmaceutical distributors supplemented budget revenues, while voluntary price and margin restrictions came into effect for dozens of products from 2025.

We call it social responsibility and the extension of public burden sharing that between 2010 and 2025, the government collected HUF 14,956 billion from these companies, and this year another HUF 1,922 billion,”

he said.

These companies did not go bankrupt and continue to operate profitably, but

we have allocated part of their resources to family support, the utility subsidy system, the 13th and 14th month pensions, rural development, and home creation programs,

explained Balázs Orbán. According to the politician, if the national government’s economic policy had not prevailed in the recent period, multinational companies would have had nearly HUF 15,000 billion more at their disposal today. This generates conflicts,

which is why part of big capital has lined up behind the Tisza Party (the main opposition – editor’s note).

The challenge for the coming years is whether this model will continue or whether a reversal will begin, he pointed out. “If we allow the Tisza-Brussels-big capital coalition to come to power, their primary goal will be to prevent us from collecting the HUF 1,922 billion due in 2026. If they succeed, they will begin to collect back the HUF 14,956 billion that we have taken from them so far and given to the Hungarian people,” wrote Balázs Orbán.

Related article

Pope Francis Recognizes Bishop Áron Márton’s Heroic Sacrifice

Bishop Áron Márton, Bishop of Alba Iulia, opposed WWII Jewish deportations and resisted communist rule.Continue reading

Via hirado.hu; Featured photo: Pexels

The post Government Redirects Multinational Taxes to Support Families appeared first on Hungary Today.

Source link