-

Jackie Kennedy ignored Maria Callas’ affair with husband Aristotle Onassis: pal - 7 mins ago

-

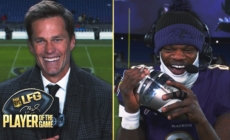

Lamar Jackson on Ravens' win over Steelers and clinching the playoffs – 'It feels good' | NFL on FOX - 11 mins ago

-

Yankees Likely To Sign Alex Bregman Following Paul Goldschmidt Deal - 34 mins ago

-

The Circle of Light Closes and Illuminates the World - 52 mins ago

-

Texas, fueled by adversity and last year’s CFP loss, tops Clemson in playoff opener - 56 mins ago

-

College Football Playoff: Texas Eliminates Clemson, Will Play Arizona State in Peach Bowl - about 1 hour ago

-

Juju Watkins drills a 3-pointer over Paige Bueckers, extending USC’s lead over UConn - 2 hours ago

-

How To Get Your Steps in Over the Holidays, According to Personal Trainers - 2 hours ago

-

Tom Brady's LFG Player of the Game: Ravens' Lamar Jackson | Week 16 DIGITAL EXCLUSIVE - 2 hours ago

-

Alpha Prime Racing Confirms Huge Crew Chief Signing For NASCAR Xfinity Series - 3 hours ago

Banking system has plenty of liquidity

The Hungarian National Bank (MNB) has presented a positive assessment of the banking sector in its latest stability report.

Zita Fellner, Chief Economist at the MNB, emphasised the stability of the banking system. The sector would remain stable even in the event of an unexpected and prolonged economic downturn. In the first half of 2024, the domestic banking sector generated a historically high profit after tax of 934 billion forints (just over 2.3 billion euros). The banking system is resilient with exceptionally high profitability, ample liquidity and adequate capitalisation. The sector’s free capital reached 1,970 billion forints by the middle of the year.

Non-performing loans at a historic low

The share of non-performing loans remains at a historically low level in both the corporate and household segments – in the corporate sector it stagnated at 3.8%, while in the household segment it fell further to 2.3%. The quality of the loan portfolio in the corporate customer segment could be jeopardised by a devaluation of commercial property. However, the resulting risks would be mitigated by the expected stabilisation of the property market.

Residential property loans more than doubled

Annual growth in corporate loans slowed to 3.7% in the sector as a whole and to 0.7% in the SME segment. At the same time, personal loans increased significantly. The reasons for this are a stable employment situation and rising real wages. The volume of housing loans more than doubled year-on-year, with both the number of loans and their volume increasing.

Source link