-

Yankees Likely To Sign Alex Bregman Following Paul Goldschmidt Deal - 28 mins ago

-

The Circle of Light Closes and Illuminates the World - 47 mins ago

-

Texas, fueled by adversity and last year’s CFP loss, tops Clemson in playoff opener - 50 mins ago

-

College Football Playoff: Texas Eliminates Clemson, Will Play Arizona State in Peach Bowl - about 1 hour ago

-

Juju Watkins drills a 3-pointer over Paige Bueckers, extending USC’s lead over UConn - 2 hours ago

-

How To Get Your Steps in Over the Holidays, According to Personal Trainers - 2 hours ago

-

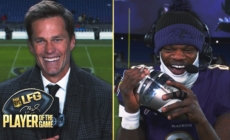

Tom Brady's LFG Player of the Game: Ravens' Lamar Jackson | Week 16 DIGITAL EXCLUSIVE - 2 hours ago

-

Alpha Prime Racing Confirms Huge Crew Chief Signing For NASCAR Xfinity Series - 2 hours ago

-

2 U.S. Navy pilots eject to safety after friendly fire downs their fighter jet - 3 hours ago

-

JuJu Watkins and No. 7 USC hold off Paige Bueckers and fourth-ranked UConn 72-70 - 3 hours ago

Bitcoin Overtakes Silver in Market Valuation Amid ‘Trump Effect’

Bitcoin has become the eighth largest asset in the world following Donald Trump’s election success last week.

In the last 24 hours, the cryptocurrency overtook silver to become the world’s eighth largest asset, reaching a market capitalization of $1.752 trillion and narrowly surpassing silver’s $1.726 trillion.

Following Trump’s win in the November 5 presidential election over his Democratic opponent Kamala Harris, there have been boosts to traditional currency and cryptocurrency markets, individual stocks, and the broader U.S. equity markets, as investors anticipate deregulation and tax cuts under the 47th U.S. president. Techgraph has called the boosts the “Trump Effect.”

Bitcoin is now catching up on the $1.804 trillion valuation of Saudi Aramco, Saudi Arabia’s majority state-owned petroleum and natural gas company. It still lags considerably behind tech giants like Microsoft, Apple and Google, as well as software company NVIDIA, all of which make the top five. Gold maintains its position as the world’s top valued asset with a market cap of $17.6 trillion.

There have also been rallies among cryptocurrency prices, spearheaded by Bitcoin, having risen by 15.03 percent in the past five days to $87,320.08. The world’s biggest and most well-known cryptocurrency has now more than doubled from a year’s low of $38,505 in January.

Ethereum has also risen to $3,275.43, after a five-day increase of 13.09 percent. Dogecoin rose 102.48 percent to $0.39 in the five days leading up to Tuesday, November 12.

Chip Somodevilla/GETTY

During his 2024 campaign, Trump’s interest in the cryptocurrency market grew, despite him previously deriding Bitcoin as “a scam.”

“I don’t like it because it’s another currency competing against the dollar,” he said in 2021. He later said he wanted the U.S. to become “the crypto capital of the planet.”

Though he has yet to outline any specific policies, Trump has since engaged with the crypto community and attended industry events, including appearances as a keynote speaker at Bitcoin 2024 in Nashville, Tennessee, in July. He even announced the launch of his own crypto venture, World Liberty Financial, in September this year.

Newsweek has contacted Trump’s campaign team for comment via email.

His change of tune has created expectations of a regulatory easing around cryptocurrencies. During his appearance in Nashville, he pledged to sack the chair of the Securities and Exchange Commission (SEC), Gary Gensler, who has been in charge of efforts by incumbent President Joe Biden’s administration to increase sector oversight.

“If the Trump administration does deregulate crypto, it’s hard to see how it is not bullish for the sector,” Matt Simpson, market analyst at StoneX Financial, told the BBC.

Simpson, senior market analyst at City Index, told Reuters: “Bitcoin’s Trump-pump is alive and well… with Republicans on the cusp of taking the house to confirm a red wave in Congress, it seems the crypto crowd are betting on digital-currency deregulation.”

Source link