-

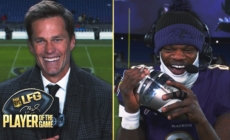

Tom Brady's LFG Player of the Game: Ravens' Lamar Jackson | Week 16 DIGITAL EXCLUSIVE - 26 mins ago

-

Alpha Prime Racing Confirms Huge Crew Chief Signing For NASCAR Xfinity Series - 36 mins ago

-

2 U.S. Navy pilots eject to safety after friendly fire downs their fighter jet - 41 mins ago

-

JuJu Watkins and No. 7 USC hold off Paige Bueckers and fourth-ranked UConn 72-70 - about 1 hour ago

-

Today’s ‘Wordle’ #1,282 Answers, Hints and Clues for Sunday, December 22 - about 1 hour ago

-

‘Connections’ December 22: Hints and Answers for Game #560 - 2 hours ago

-

No. 7 USC Trojans vs. No. 4 UConn Huskies | Paige Bueckers vs. JuJu Watkins thriller | FOX CBB - 2 hours ago

-

College Football Playoff: Ohio State Routs Tennessee, Will Face Oregon in Rose Bowl - 3 hours ago

-

Tom Brady picks his Super Bowl favorite a few weeks before NFL playoffs start - 3 hours ago

-

Dodgers Reportedly Battling With Blue Jays, Red Sox For Teoscar Hernández - 3 hours ago

China’s stressed and overworked youth skip the tea and reach for coffee

BEIJING — For more and more people in China, coffee has become their cup of tea.

Last year, China overtook the United States as the country with the most branded coffee shops in the world, according to a report by World Coffee Portal. The number of outlets in China grew 58% in 2023 to almost 50,000, compared with about 40,000 in the U.S.

The Chinese coffee market used to be dominated by foreign brands such as Starbucks, Tim Hortons of Canada and Costa Coffee from Britain. But they face intensifying competition from Chinese coffee chains such as Luckin, Cotti and Manner, as well as local independent cafés in big cities like Beijing.

For coffee drinkers, that means more choice than ever, whether it’s a plain Americano or a latte infused with pork flavors or Chinese liquor.

Though tea remains foundational to Chinese culture, some young, middle-class consumers are finding coffee’s caffeine kick to be more suited to the pressures of a competitive job market and workplace.

Li Yizhe, 26, said in the past two years she had started drinking coffee every day as a way to boost her energy.

“I used to drink milk tea, but now I’ve shifted to coffee,” Li, a government worker, said while sitting at an artisanal coffee shop in a Beijing hutong, or alley.

Zhang Jian, a 33-year-old freelancer, said he has about a cup of coffee a day, often at Luckin.

“It’s convenient to buy because the stores are everywhere, and the prices are also budget-friendly,” he said.

He cited the high job stress and long hours workers face as reasons for coffee’s growing popularity, as well as the addictive nature of caffeine.

“As colleagues start to pick up the habit, it gradually forms a coffee culture,” he said.

China’s demand for coffee will reach an estimated 5 million bags in the 2023-24 season, the U.S. Department of Agriculture reported, making it the seventh-biggest consumer in the world. That compares with more than 20 million bags for the two biggest coffee-consuming countries, the U.S. and Brazil.

The rise in Western-style coffee consumption in China can be attributed to a shift in lifestyle preferences as more people have more disposable income, said Nirmit Limbachia, project lead for food and beverage at Mordor Intelligence, a market research firm based in India. Urbanization, globalization and the rapid expansion of both domestic and foreign coffee shops have also made international coffee culture “more accessible and familiar,” he said.

Last year, Luckin overtook Starbucks as the largest coffee chain in China, Starbucks’ biggest market after the U.S. Luckin opened more than 5,000 stores in China in 2023 for a total of more than 13,000, World Coffee Portal said, compared with more than 6,800 for Starbucks, which opened 785 stores in China last year.

The U.S. company says it surpassed 7,000 stores in January and aims to have 9,000 stores across China by next year.

Zhang said it was “surprising” to see how many stores Luckin has now, seven years after it was founded in Beijing.

When Luckin first emerged, he said, “they claimed to be the coffee for Chinese people. At that time, many consumers were skeptical about Luckin’s ability to last and maintain stability.”

That skepticism was only reinforced in 2020, when Luckin was found to have inflated the previous year’s sales figures by more than $300 million. The company has since emerged from bankruptcy and replaced the executives involved in the scandal.

Luckin and other domestic chains have caught up by “expanding to new cities, offering competitive pricing, and leveraging technology for convenient ordering and delivery services,” Limbachia said.

“Domestic coffee chains often emphasize localization in their offerings, incorporating traditional Chinese ingredients and flavors into their menu items,” he continued. “They also tend to cater to the preferences of Chinese consumers in terms of ambience and service.”

This month, Luckin opened a store in the southern Chinese city of Shenzhen that is co-branded with Kweichow Moutai, a luxury brand of the popular Chinese spirit baijiu. The store aims to capitalize on the success of a baijiu-infused latte the two companies collaborated on last year, which according to Limbachia sold 5.42 million cups on its first day and generated more than 900 million yuan ($124 million) in total sales.

“Adding baijiu in coffee is a commercial stunt, but at the same time it caters to Chinese people’s drinking habits,” said Wang Zichen, 29, a former café owner in Beijing.

Starbucks, which has been in China since 1999, says the Chinese coffee market is still evolving and “has not yet fully tiered.”

“You see an influx of mass-market competitors focused on fast store expansion and low-price tactics to drive trial,” Belinda Wong, chairwoman and co-chief executive of Starbucks China, said on an earnings call in January. “This will shake out over time.”

The competition has pushed foreign chains such as Starbucks to pay more attention to Chinese tastes, Limbachia said, including “adjusting menu options, adapting store designs and forming partnerships with local businesses.”

For the Lunar New Year in February, Starbucks offered a limited-edition pork-flavored latte at its 25 Reserve stores for 68 yuan ($9.45). Garnished with a piece of pork and topped with a drizzle of pork sauce, the drink was inspired by Dongpo braised pork, a classic dish from eastern China that is served at traditional family gatherings.

While the company plans to “dial up” such product innovations, Wong said, it is “not interested in entering the price war.”

“We’re focusing on capturing high-quality but profitable sustainable growth,” she said. “It is our aim to be the best and lead in the premium market.”

Limbachia said both domestic and foreign chains could expect continued growth as coffee consumption becomes more ingrained in Chinese culture, for example through expansion into smaller cities and rural areas.

Wang, the former café owner, said older people were also starting to drink coffee.

“As coffee becomes a national drink, it will be more inclusive and diverse, and then it will become more popular,” he said. “For cafés, the increase in customers means that the entire industry is developing for the better.”

Source link