-

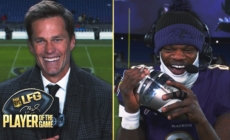

Tom Brady's LFG Player of the Game: Ravens' Lamar Jackson | Week 16 DIGITAL EXCLUSIVE - 12 mins ago

-

Alpha Prime Racing Confirms Huge Crew Chief Signing For NASCAR Xfinity Series - 22 mins ago

-

2 U.S. Navy pilots eject to safety after friendly fire downs their fighter jet - 27 mins ago

-

JuJu Watkins and No. 7 USC hold off Paige Bueckers and fourth-ranked UConn 72-70 - 55 mins ago

-

Today’s ‘Wordle’ #1,282 Answers, Hints and Clues for Sunday, December 22 - about 1 hour ago

-

‘Connections’ December 22: Hints and Answers for Game #560 - 2 hours ago

-

No. 7 USC Trojans vs. No. 4 UConn Huskies | Paige Bueckers vs. JuJu Watkins thriller | FOX CBB - 2 hours ago

-

College Football Playoff: Ohio State Routs Tennessee, Will Face Oregon in Rose Bowl - 2 hours ago

-

Tom Brady picks his Super Bowl favorite a few weeks before NFL playoffs start - 2 hours ago

-

Dodgers Reportedly Battling With Blue Jays, Red Sox For Teoscar Hernández - 3 hours ago

Man Sees $600,000 Increase in Hawaii Home Value After ‘Easy’ Renovations

Flipping houses can often lead to a six-figure profit, and many look around for investment properties in search of just that.

But Greg Gaudet, who purchased a Hawaii house that’s grown $600,000 in value since he bought it in 2022, said he wouldn’t dream of selling.

The Maui home originally was priced at $855,000, and after investing $25,000 into repairs and upgrades, the home appraisal has skyrocketed to $1.5 million.

“On paper, I have made well over $600,000 in two years just by owning this house. But I wouldn’t dream of selling it.” Gaudet, age 39, told Newsweek.

Greg Gaudet

Since buying the home, Gaudet, who is now a real estate investor at Maui Home Buyers, rents out the space and easily earns more than $5,000 per month.

At the time of purchase, Gaudet had a good feeling the home would make a compelling investment down the line, but in many ways, the stars aligned based on the market and price.

“I thought it would be a good investment, and knew I was getting a good price,” Gaudet said. “But I was just really lucky with the market and my timing.”

He says when it comes to finding a top investment property, cash flow and price are the two biggest factors.

By finding a home that you can easily convert into a renting side hustle or transform into a much higher buyout value, you’ll be set up to bring in some significant money into your bank account.

Typically, homes in desirable locations that have a significant amount of work to be done inside have the best odds of bringing in a hefty profit.

Gaudet said on his part, the repairs only took a few hours of his time to find a reputable contractor and get the house looking rent ready. Still, he cautions others from diving in before they’re ready.

“Don’t buy an investment property unless you can run the numbers and see that it will be profitable on day one,” Gaudet said. “Don’t count on prices or rents going up forever.”

Still, for Gaudet, it was undeniably the right choice, and he now has more financial freedom than before.

“It changed my life because it allowed me to leave my day job and work full time on my real estate investing side hustle,” Gaudet said.

Gaudet isn’t the only person who’s brought into hundreds of thousands from a real estate side hustle.

Blake Busson, who now owns Busson Home Buyers, profited $180,000 on a home he purchased just 45 miles north of Los Angeles.

Greg Gaudet

The home was initially a $730,000 purchase, and Busson had to spend $108,000 on fixing its roof and walking. Still, after putting the home on the market, it was easily worth it.

“It only lasted a week on the market and I received an offer $35,000 over asking price,” Busson told Newsweek, adding he’s now $180,000 richer after the house flip.

“I rinse and repeat, use the profits along with capital to reinvest into the next flip property.”

What To Look Out For in Investment Properties

Realtors say the best way to maximize your profits during a house flipping operation is to find a house that needs a few cosmetic updates in a top-tier location.

“Buyers will pay a premium both for a renovated, move-in ready home, but also for prime location,” Melissa Rubenstein, a realtor at Corcoran Infinity Properties, told Newsweek.

As an investor, you will likely need to add real value to the home via upgrades and repairs, but that doesn’t always have to be a big hit to your wallet, especially considering your future payday if you decide to sell.

Some may be cautious about spending the big bucks in a top real estate market, but the benefits could outweigh the cons in the long run, according to Realtor.com chief economist Danielle Hale.

“While working in a hot real estate market may be more challenging when trying to secure the investment purchase, operating in a hot real estate market should mean a faster sale,” Hale told Newsweek, adding that some of the newer top markets include affordable midwest and Northeast metros.

Looking at similar properties in the neighborhood will show you what your home could likely sell for, given the proper updates and repairs. The traditional wisdom is to buy low and sell high, with extra awareness of the extra expenses that could pop up during this process.

But that’s what you should consider before the point of sale, Andrew Clark, a realtor in the Dallas-Fort Worth area, said – not after.

“You make all your money when you buy the home,” Clark told Newsweek. “The majority of your analysis, time, effort, and calculating should take place before you buy the home. Investing in flips is a numbers game.”

But even following all the expert realtor advice doesn’t mean you’ll enter the flipping home business without risk, Community Choice Realty’s Jason Gelios cautioned.

“The general public typically sees real estate investing as glamorous when in reality, it comes with hurdles that will need to be overcome, such as being over budget, not being prepared for unexpected issues and obtaining the right certifications from the city,” Gelios told Newsweek. “Be sure to do as much research as you can on a property before purchasing it.

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Source link