-

Rory McIlroy Makes Sweeping Changes at Arnold Palmer Invitational - 9 mins ago

-

Singer Tommy James stops concert from ‘exhaustion’ - 21 mins ago

-

LIV Golf Hong Kong: Final Round Highlights | LIV on FOX - 29 mins ago

-

Yankees GM Warns Defense-Challenged $5.1 Million Rookie to ‘Earn’ Place on Team - 48 mins ago

-

Karla Sofía Gascón ‘contemplated the unthinkable’ amid social media scandal - about 1 hour ago

-

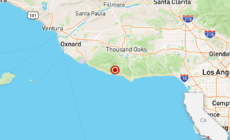

4.1 earthquake felt across Southern California, centered near Malibu - about 1 hour ago

-

Villanova Wildcats vs. UConn Huskies Big East Tournament Highlights | FOX College Hoops - about 1 hour ago

-

How to Watch Big Ten Championships: Live Stream College Wrestling, TV Channel - about 1 hour ago

-

Rob Lowe said participating in sex scenes was required of him back in the day - 2 hours ago

-

Cyclists hit by car while giving out immigration rights cards in Boyle Heights - 2 hours ago

Nagy: Still not enough! – The Budapest Times

‘We have to get involved in the corporate credit segment, because 3% growth is too little,’ said the Minister of Economics on Info-Radio.

Márton Nagy referred to the ongoing talks with the commercial banks on how more loans can be activated. All the more so because loans granted in forints are in absolute deficit: When companies take out new loans, they tend to do so in foreign currency.

The objectives of companies as borrowers are mostly measures to increase efficiency or to finance current business, while the economic department wants to see investments. In the case of Széchenyi card constructions, the subsidised interest rate was reduced from 5 to 3.5% in order to stimulate investment – however, the increase of just under 50 billion forints achieved at the end of the year is still too little. Nagy now expects proposals from the commercial banks, in whose interest an intensified credit business must be.

Source link