-

College basketball weekend preview: Top five matchups to tune into Saturday - 19 mins ago

-

Heart-wrenching opening for trial of O.C. judge who fatally shot wife - 33 mins ago

-

DOGE Stimulus Check Creator Wants it to Motivate People to Report Waste - 37 mins ago

-

Body of Shiri Bibas handed over; release of six more hostages underway - 41 mins ago

-

Eagles LB Nolan Smith played through Super Bowl LIX with torn triceps - about 1 hour ago

-

Taylor Swift’s ‘It Ends With Us’ connection uncovered in resurfaced interview - about 1 hour ago

-

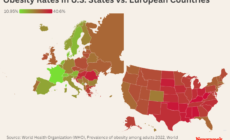

Map Reveals How Obesity Rates in the U.S Compares to Europe - about 1 hour ago

-

In reversal, Trump says Russia attacked Ukraine - 2 hours ago

-

Jhamir Brickus drops his defender and drains a stepback 3-pointer, extending Villanova's lead vs. Marquette - 2 hours ago

-

Winter Weather Warnings in 4 States As Blowing Snow To Strike - 2 hours ago

Putin’s Economy Suffers Another Blow

Chinese banks are refusing to work with sanctioned financial institutions in Russia, delivering another blow to the economy, which has been hit hard by Russian leader Vladimir Putin’s invasion of Ukraine.

China has been Russia’s key trading partner since the start of the war in Ukraine in February 2022 after U.S.-led sanctions dried up Western markets. While Putin has touted his close ties with Chinese leader Xi Jinping, China is not the economic partner it was in 2023 when there was a record $240 billion in trade between the countries. Newsweek has emailed Russia’s Finance Ministry for comment.

Chinese traders have been getting jittery about the prospect of secondary sanctions, especially following the November 21 round of measures the U.S. Treasury Department imposed on over 50 Russian credit institutions.

ALEXANDER NEMENOV/Getty Images

Among them was Gazprombank, the main outlet for payments of Russia’s gas exports. Its inclusion on the list was a factor in the Russian currency, the ruble, plunging to its lowest level against the U.S. dollar for 32 months.

The ruble also dropped against the Chinese currency, the yuan, prompting Chinese exporters concerned about losses in doing business with Russia to suspend sales on Russian e-commerce platforms.

Now trade between Russia and China faces another barrier after most Chinese banks terminated their relations with Russian credit institutions, general director of investment and consulting firm First Group, Alexey Poroshin, told the Russian daily broadsheet newspaper Izvestia.

This was also confirmed to the Russian outlet by Alexei Razumovsky, the commercial director of Impaya Rus. He said that the Bank of China is already refusing to accept payments from Russian banks that are on the new sanctions list.

Clients of China’s Bank of Kunlun, which Russian importers often used to pay for goods, have said that they were informed about payments from sanctioned banks were not being accepted.

Roman Tikhonov, director of products at fintech company Paygine, told the outlet he expects other Chinese institutions are likely to follow suit.

Russian media have widely reported the consequences of the Biden administration’s latest sanctions, portraying them as efforts by the outgoing president to exert as much pressure as he can on Putin before he leaves office.

However, Poroshin told Izvestia that he did not expect the situation on trading with China to improve, even when Donald Trump enters the White House. But Alexei Tarapovsky, founder of Anderida Financial Group, did express hope that the new U.S. president could usher in an easing of sanctions.

Source link