-

An earthquake just off California’s coast poses dire tsunami risk for many communities - 11 mins ago

-

Iranian rapper Tataloo once supported a hard-line presidential candidate. Now he faces execution - 26 mins ago

-

Mom Captures Moment With Toddler, Just Days Later She’ll Be Gone - 34 mins ago

-

Last Night in Baseball: Francisco Lindor hits two-run double on broken toe - 47 mins ago

-

How ‘Cali’ became a slur among Vietnam’s growing army of nationalists - 50 mins ago

-

Scottie Scheffler Tweaks Tour Schedule with Major Ramifications - about 1 hour ago

-

Why were so many Thai farmers among the hostages held by Hamas? - about 1 hour ago

-

Will the Santa Cruz Wharf be rebuilt after it broke apart? - about 1 hour ago

-

Braves vs. Giants Highlights | MLB on FOX - 2 hours ago

-

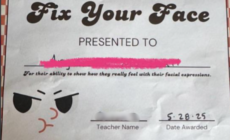

Teacher’s Award for Girl in Seventh Grade Sparks Debate: ‘Poor Kiddo’ - 2 hours ago

Dollar Tree says U.S. tariffs could cut its second-quarter profits in half

Dollar Tree, a chain of discount stores, warned Wednesday that President Trump’s import tariffs could lower its second-quarter earnings by as much as 50% compared to the year-ago period.

The Chesapeake, Virginia-based retailer sources most of its inventory, which ranges from disposable tableware, party supplies and toys to puzzles and clothing, from China, making it vulnerable to higher U.S. tariffs on the Asian economic giant.

Mr. Trump earlier this year imposed tariffs of 145% on Chinese imports, claiming Beijing hasn’t taken sufficient steps to stem the flow of fentanyl into the U.S., before lowering the rate last month to 30% as the sides discuss trade issues. Even at the reduced rate, some businesses say the levies would make importing Chinese-made goods prohibitively expensive.

Dollar Tree CEO Mike Creedon said in an earnings call with Wall Street analysts on Wednesday that he expects the tariffs to hurt the company’s earnings in the near-term.

“We are actively engaged on multiple fronts to mitigate the impact of inflationary cost pressures including tariffs,” he added, while acknowledging that “the tariff landscape is highly fluid and changing week to week.”

The company is leveraging its relationships with suppliers to keep its costs as low as possible, Creedon noted.

“Given the volatility of today’s operating environment, it is challenging to predict with precision the near-term performance of the business in Q2 — especially regarding tariff and other cost-mitigation efforts,” he said.

The company’s second-quarter earnings per share could drop by as much as 50% compared to the same period a year earlier, according to Dollar Tree. The company forecast its earnings to rebound in the third and fourth quarters as it expects being able to “mitigate most of the incremental margin pressure from higher tariffs and other input costs” for the whole year, Dollar Tree said in a statement.

For the first quarter, the retail chain posted revenue of $4.6 billion and said it expects 2025 earnings in the range of $5.15 to $5.65 per share. It expects full-year revenue of between $18.5 billion and $19.1 billion.

Dollar Tree said on Wednesday’s call that higher-income customers have driven growth across its more than 15,500 store locations, a sign its prices are appealing to a broad range of consumers look for deals.

The business has also sold its Family Dollar chain store brand in a deal it expects will close this summer. The $1 billion sale of Family Dollar to two private equity firms will allow Dollar Tree to “sharpen its operational focus” and generate cash flow, Creedon said.

Source link