-

Juju Watkins blocks Paige Bueckers and lays it up on the other end, extending USC’s lead vs. UConn - 19 mins ago

-

Former NASCAR Driver Confirms Full-Time Racing Return In 2025 - 45 mins ago

-

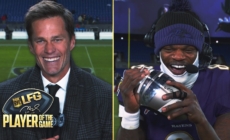

Tom Brady’s LFG Player of the Game for Week 16: Ravens QB Lamar Jackson - about 1 hour ago

-

Chandler Smith Secures Full-Time NASCAR Drive After Joe Gibbs Racing Exit - about 1 hour ago

-

Tom Brady praises Lamar Jackson & Derrick Henry in Ravens' win vs. Steelers | NFL on FOX - 2 hours ago

-

At least 5 killed, 200 injured after car plows into Christmas market in Germany - 2 hours ago

-

Was Rickey Henderson Greatest MLB Player of All Time? Where Does He Rank? - 2 hours ago

-

Tom Brady is fired up by Ravens CB Marlon Humphrey's 37-yard pick-six vs. Steelers | NFL Highlights - 2 hours ago

-

Venturini Motorsports Announces Toni Breidinger ARCA Menards Replacement - 3 hours ago

-

Party City files for bankruptcy, a day after announcing mass layoffs at its headquarters - 3 hours ago

Federal Reserve is expected to make 3rd consecutive rate cut this week. Here’s what to know.

The Federal Reserve on Wednesday will make its final interest rate decision of 2024, capping a year during which the central bank provided some financial relief to inflation-weary borrowers in September by ushering in its first rate reduction in four years.

On Dec. 18, the Federal Reserve is likely to make its third consecutive reduction of 2024, according to economists polled by financial data firm FactSet. Yet many experts are also bracing for a slower pace of cuts in 2025 given the nation’s still-sticky inflation rate and some of President-elect Donald Trump’s proposed economic policies, which, if enacted, could prove inflationary.

The Federal Reserve has been battling inflation since March 2022, when it began ratcheting up rates to cool the economy, eventually pushing its benchmark rate to its highest level in 23 years. While inflation has moderated considerably since then, November’s Consumer Price Index rose 2.7%, outpacing the Fed’s goal of driving down inflation to a 2% annual rate.

That signals the battle against inflation isn’t yet over, though the November inflation report was in line with economists’ expectations. At the same time, the unemployment rate has inched higher this year, sparking concerns from the Fed about weaknesses in the labor market, and helping open the door to its recent rate reductions, noted one economist.

“The Fed will likely move ahead with another 25-basis point cut at its December meeting,” noted Jacob Channel, senior economist at LendingTree, in an email, adding,”This could be the last cut for a while though,” he said.

“Because the upcoming Trump Administration’s policies might cause a resurgence in inflation or otherwise throw the economy off balance, the Fed might choose to take a wait-and-see approach and hold rates steady at their January meeting,” Channel noted.

What date is the Federal Reserve meeting in December?

The Federal Reserve’s Federal Open Market Committee (FOMC) meeting is from Dec. 17-18, marking its last meeting of the year.

What time does the Federal Reserve announce rates?

The central bank is set to announce its rate decision on Dec. 18 at 2 p.m. ET.

That will be followed by a press conference with Federal Reserve Chair Jerome Powell at 2:30 p.m. ET, during which Powell will discuss the Fed’s economic outlook and take questions from reporters.

Will the Fed cut rates in December?

About 9 in 10 economists polled by financial data firm FactSet are forecasting that the Fed will cut its benchmark rate by 0.25 percentage points on Wednesday.

If that occurs, the federal funds rate — the interest rate banks charge each other for short-term loans — will be lowered to a range of 4.25% to 4.5%, down from its current target range of 4.5% to 4.75%.

That would mark the Fed’s third consecutive rate cut this year, which kicked off with a jumbo 0.5 percentage point reduction in September, followed by a 0.25 percentage point cut at its November meeting.

How will another rate cut impact my money?

Any reduction in the federal funds rate could ease borrowing costs for millions of Americans. But a 0.25 percentage point cut isn’t likely to make that much of a difference, with LendingTree chief credit analyst Matt Schulz noting that it “may knock a dollar or two off your monthly debt payment.”

“Another rate cut is welcome news at the end of a chaotic year, but it ultimately doesn’t amount to much for those with debt,” Schulz said.

Still, new APR rates on credit cards have declined to 24.43% from 24.92% in September, according to LendingTree data. Loan rates for other products, such as home equity lines of credit, have also declined.

Despite the rate cuts, mortgage rates haven’t budged much and continue to hover near 20-year highs, leaving many would-be homebuyers disappointed. While the Fed’s benchmark rate influences home borrowing costs, mortgages are also impacted by broader economic trends and changes in the yield for the U.S. 10-year Treasury bond.

“Going forward, mortgage rates will likely continue to fluctuate on a week-to-week basis and it’s impossible to say for certain where they’ll end up,” LendingTree’s Channel said.

What’s going on with inflation and the economy?

Inflation, or the rate at which prices for goods and services change over time, has cooled since it reached a 40-year peak of 9.1% in June 2022.

The Fed began pushing its benchmark rate higher in 2022 in order to dampen economic demand and tame inflation. But while inflation has eased since its 2022 peak, prices for many products and services remain considerably higher than they were before the pandemic.

And prices are likely to stay high unless there’s a period of deflation, which typically only happens during a steep economic downturn, such as a recession.

That has left many Americans feeling financially tapped out, with millions taking their frustrations to the ballot box last month and voting for Trump’s economic vision of ending “the inflation nightmare.”

How might Trump’s economic plans impact the Fed?

While Trump has vowed to tackle rising prices, some of his policies could prove to be inflationary, according to Wall Street economists. For instance, Trump last month unveiled plans to place a 25% tariff on all imports from Mexico and Canada on his inauguration day, January 20.

The president-elect also said he intends to levy an additional 10% fee on all imports from China.

But tariffs are essentially consumption taxes that are most often paid by consumers. In other words, American shoppers could end up paying more for everything from avocados imported from Mexico to TV sets manufactured in China.

Because of the potential for inflation to tick higher in 2025 if Trump enacts widespread tariffs, many economists expect the Fed to slow or pause in its rate decisions next year in a wait-and-see approach.

“Fed officials might prefer to be cautious in light of uncertainty about the new administration’s policies, especially possible tariff increases,” noted Goldman Sachs economists in a Dec. 15 research report.

Will the Federal Reserve cut rates in 2025?

Economists are forecasting that the Fed will continue to cut rates next year, although some are scaling back the number of reductions they’ve penciled in.

The Fed will release its summary of economic projections (SEP) on Dec. 18, which will provide some insight into what the FOMC is expecting in 2025.

It’s possible the Fed’s outlook will forecast three rate cuts in 2025 of 0.25 percentage points each, down from four rate cuts the central bank had penciled in when it last released the SEP, in September, according to EY chief economist Gregory Daco in an email.

At his Wednesday press conference, Powell could “reiterate the familiar metaphor of moving slowly in a dark room full of objects to justify a potential rate cut ‘skip’ at the January meeting,” Daco added.

Source link