-

Yankees Likely To Sign Alex Bregman Following Paul Goldschmidt Deal - 12 mins ago

-

The Circle of Light Closes and Illuminates the World - 31 mins ago

-

Texas, fueled by adversity and last year’s CFP loss, tops Clemson in playoff opener - 34 mins ago

-

College Football Playoff: Texas Eliminates Clemson, Will Play Arizona State in Peach Bowl - 54 mins ago

-

Juju Watkins drills a 3-pointer over Paige Bueckers, extending USC’s lead over UConn - about 1 hour ago

-

How To Get Your Steps in Over the Holidays, According to Personal Trainers - 2 hours ago

-

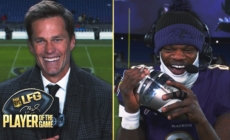

Tom Brady's LFG Player of the Game: Ravens' Lamar Jackson | Week 16 DIGITAL EXCLUSIVE - 2 hours ago

-

Alpha Prime Racing Confirms Huge Crew Chief Signing For NASCAR Xfinity Series - 2 hours ago

-

2 U.S. Navy pilots eject to safety after friendly fire downs their fighter jet - 2 hours ago

-

JuJu Watkins and No. 7 USC hold off Paige Bueckers and fourth-ranked UConn 72-70 - 3 hours ago

Credit Karma customers who were deceived by the credit service’s company’s alleged false “pre-approved” offers will get $2.5 million from the Federal Trade Commission (FTC).

The FTC on Thursday announced that it is sending payments to nearly 51,000 consumers who filed a valid claim with the commission before a March deadline.

It first took action against Credit Karma in 2022, after claiming that around one-third of some customers who were “pre-approved” for credit by the company were in fact denied. The FTC claimed Credit Karma pre-approved customers to entice them to apply for offers that they were unlikely to qualify for. It allegedly used dark patterns — website or app designs that can mislead consumers — to do so.

Credit Karma, which provides users with tools to monitor their credit scores and reports, told some users that they had “90% odds” of being approved for credit products, according to the FTC. Such practices wasted consumers’ time and could have damaged their credit scores, the agency said.

Credit Karma has agreed to an FTC order requiring it to stop making these types of claims, in addition to compensating those harmed by the practice.

“We fundamentally disagree with allegations the FTC makes in their complaint, which relate solely to statements we ceased making years ago. Any implication that Credit Karma rejected consumers applying for credit cards is simply incorrect, as Credit Karma is not a lender and does not make lending decisions,” the company said in a statement to CBS MoneyWatch.

“We reached this agreement to put the matter behind us so we can maintain our focus on helping our members find the financial products that are right for them,” the company said.