-

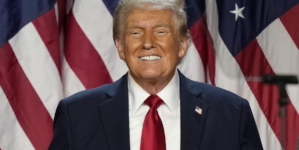

Trump’s Election Raises Inflation Fears as Fed Prepares Second Rate Cut - 5 mins ago

-

Australia proposes ‘world-leading’ ban on social media for those under 16 - 12 mins ago

-

Mountain fire: Evacuations, road closures, shelters, school closures - 18 mins ago

-

Sacred Heart Pioneers vs. No. 3 UConn Huskies Highlights | FOX College Hoops - 25 mins ago

-

Van Jones’ Warning on Potential Trump Cabinet: ‘Worst of the Worst’ - 45 mins ago

-

Donald Trump ahead in O.C. after losing in the county twice before - 57 mins ago

-

Ryan Kalkbrenner drops a 49-point double-double in Creighton's 99-86 win over UTRGV - about 1 hour ago

-

NYT ‘Connections’ November 7: Clues and Answers for Game #515 - about 1 hour ago

-

Parts of Orange County are quarantined for invasive fruit fly - 2 hours ago

-

Paul George booed in return to LA for first time since leaving Clippers to join 76ers - 2 hours ago

It is a marker of the challenges of getting on the property train in the U.S. these days: The typical homebuyer today is older than ever, as well as wealthier, new data shows.

The average age of homebuyers in 2024 was 56, a record high, according to a report from the National Association of Realtors (NAR), highlighting the impact of soaring housing prices and elevated mortgage rates. That’s up from 49-years-old last year, the trade group found.

First-time buyers also tend to be older. The median first-time buyer this year was 38-years-old, up from 35 in 2023. Roughly a quarter of those getting into homeownership were first-time buyers, down from 32% last year and the lowest share since NAR started tracking those numbers in 1981.

“First-time buyers face high home prices, high mortgage interest rates and limited inventory, making them a decade older with significantly higher incomes than previous generations of buyers,” NAR deputy chief economist Jessica Lautz said in a statement.

A record share of U.S. homes are valued at $1 million or more, with tight supply driving prices up to record highs across the nation, a recent Redfin report shows. In the largest U.S. cities, even people with relatively high incomes struggle to afford homeownership.

Through September, the price of single-family homes rose 3.4% from a year ago, according to CoreLogic. The median sale price in September was roughly $427,500, according to Redfin.