-

California’s Great America wraps winter season. Could it be the last? - 10 mins ago

-

Russia Advance in Toretsk Leaves ‘Total Devastation’: Ukrainian Commander - 14 mins ago

-

Trump appears with Italian Prime Minister Meloni at Mar-a-Lago - 17 mins ago

-

No. 1 UCLA Bruins vs. Indiana Hoosiers Highlights | FOX College Women’s Hoops - 29 mins ago

-

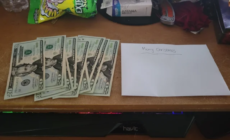

Dad-of-2 Finds Note From Neighbor He Never Met, Can’t Believe What’s Inside - 52 mins ago

-

Elvis Presley turned down ‘A Star is Born’ for this reason: author - 57 mins ago

-

Suspected Nazi collaborators named in the Netherlands - about 1 hour ago

-

Chicago Bulls plan to retire ‘hometown hero’ Derrick Rose’s jersey next season - about 1 hour ago

-

Dog Dumped by Owner Travels for 5 Days To Find Sister in Shelter - 2 hours ago

-

Denzel Washington tops major year with 11th Golden Globes nomination - 2 hours ago

Where are interest rates on mortgages, CDs and credit cards heading in 2025?

Americans started to see some financial relief in 2024 as cooling inflation led the Federal Reserve to cut interest rates three times after jacking up borrowing costs to their highest level in 23 years in a bid to hose down red-hot prices.

The Fed’s policy shift raises questions about what 2025 might bring for borrowers, especially on the home-buying front, where mortgage rates have remained stubbornly high despite the rate cuts. On Jan. 2, the 30-year fixed rate mortgage inched up to 6.91%, its highest point in almost six months, Freddie Mac said on Monday.

Complicating the financial picture are President-elect Donald Trump’s economic plans. Those could include sweeping new tariffs on foreign goods and more tax cuts, policies economists warn could reignite inflation. If that occurs, the Fed could be hard-pressed to continue its rate-cutting push.

To be sure, Trump may be using the threat of aggressive new tariffs chiefly as a bargaining tactic to win better trading terms from other nations, while inflation may continue to drift lower this year, giving the Fed room to continue cutting rates. For now, however, uncertainty over Trump’s policies and their potential impact on the economy, according to Brent Schutte, chief investment officer at Northwestern Mutual Wealth Management Company, leaves unanswered questions for investors and consumers.

“For much of the past year, investors have viewed rate cuts as a key ingredient that would take pressure off struggling portions of the economy and lead to a broadening of the market,” he noted, in a research note last month.

Read on about to see what financial experts predict for interest rates for 2025.

Will the Fed cut rates again in 2025?

Most economists think the Fed will continue to cut rates this year, although many have pared their forecasts for the number of cuts given stickier-than-expected inflation in the second half of 2024.

At its December policy meeting, the Fed projected that it will loosen rates less next year than it had previously expected. The central bank is now penciling in only two rate cuts in 2025, down from the four it had forecast in September.

Some economists are projecting three rate cuts this year, including Goldman Sachs, whose economists expect rates to end 2025 in the range of 3.5% to 3.75%, down from its current range of 4.25% to 4.5%. Economists are currently split on whether the Fed will again lower its benchmark rate at its January 28-29 meeting.

“Stubborn inflation and economic growth that has surprised to the upside in 2024 will give way to stubborn inflation and slower, still solid economic growth in 2025,” Bankrate chief financial analyst Greg McBride predicted in an email.

Will mortgage rates drop in 2025?

Mortgage rates around the U.S. have remained high despite the Fed’s three rate cuts, which have lowered the federal funds rate — what banks charge each other for short-term loans — by one percentage point.

Despite that step-down, mortgage costs haven’t seen a commensurate decline. The typical rate on a 30-year fixed-rate mortgage is now about 0.3 percentage points higher than it was in January 2024, when it stood at about 6.6%, according to Freddie Mac data.

Mortgage rates haven’t dipped along with the Fed’s cuts because they’re based on several factors besides the central bank’s benchmark rate. Those issues include the strength of the U.S. economy and changes in the yield for the U.S. 10-year Treasury bond, and experts now say home buyers might not see significant relief in 2025.

“Continued economic growth and worries about inflation and government debt will keep mortgage rates elevated,” McBride wrote.

Mortgage rates could end 2025 at 6.5%, he predicted.

That jibes with a forecast from Lawrence Yun, the chief economist of the National Association of Realtors, who told CBS MoneyWatch in November that the average 30-year fixed mortgage rate is likely to hover around 6.5% for much of 2025, although rates might bounce around between 6% and 7% over the course of the year.

Will credit card rates fall in 2025?

Credit card rates will likely decline along with additional Fed cuts in 2025, but people with revolving balances are still going to be paying high fees. It could also take up to three months for rate cuts to result in lower card APRs, McBride noted.

He expects the typical credit card to charge about 19.8% by the end of 2025. Currently, the average APR for new card offers is about 24.4%, according to LendingTree.

How will rates on CDs and savings account change in 2025?

One bright spot during the Fed’s regime of interest-rate hikes was that it boosted returns for savers, who could earn healthy returns on their money held in savings accounts, CDs and money market accounts.

Rates for these products will likely decrease if the Fed makes additional rate cuts in 2025, as they did after the central bank cut rates in late 2024. But shopping around could help savers find better deals, McBride said.

For instance, he predicted the national average for savings accounts will be 0.35% at the end of 2025, but top-yielding offers could stand at 3.8% by year-end. Top-yielding 1-year CDs could pay about 3.7%, while five-year CDs may pay 3.95% by the end of 2025, McBride forecast.

Source link