-

Supreme Court Blocks Donald Trump Deportations Under Alien Enemies Act - 32 mins ago

-

NBA playoff power rankings: Which two teams will meet in the Finals? - 35 mins ago

-

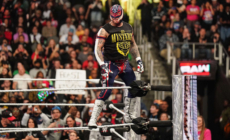

Rey Mysterio Injured Right Before WrestleMania 41: Report - about 1 hour ago

-

2025 NBA postseason predictions: SGA wins MVP over Jokic, Lakers make Finals - about 1 hour ago

-

Bet365 Bonus Code WEEK365: Get $150 Bonus as NBA Playoffs Open This Weekend - 2 hours ago

-

Francisco Lindor hits 1st walk-off homer for Mets, 250th home run of career - 2 hours ago

-

How to Watch Memphis Showboats vs Michigan Panthers: Live Stream UFL, TV Channel - 3 hours ago

-

Ja Morant shrugs off injury as Grizzlies top Mavs to move on to NBA playoffs - 3 hours ago

-

4 Prospects New York Jets Should Avoid With No. 7 Pick In 2025 NFL Draft - 3 hours ago

-

Padres vs. Astros Highlights | MLB on FOX - 4 hours ago

Californians in Congress push for break on mortgage payments after natural disasters

The Southern California lawmakers who represent the Eaton and Palisades fire zones introduced a bill in Congress on Thursday that would give homeowners affected by natural disasters nationwide a break on mortgage payments for almost a year.

The bill, introduced by U.S. Reps. Judy Chu (D-Monterey Park) and Brad Sherman (D-Sherman Oaks), would require lenders to grant a six-month pause on mortgage payments for homeowners who could document evidence of damage or destruction to their properties. Payments would be paused with no interest, penalties or fees, but would not be forgiven.

That pause, known as mortgage forbearance, would apply only to federally backed loans in areas where a federal disaster declaration has been signed by the president, said Chu, who represents Altadena. Borrowers would have the option of extending the forbearance for another six months if needed, extending the life of the loan.

“They’ve lost their home, their whole life, they’re living with friends or living in a hotel, they’re still working with their insurance company to get that hotel bill covered, or they’re applying to FEMA, and now the mortgage is due, too,” said Sherman, whose district includes Pacific Palisades and Malibu. “So it’s like paying rent or a mortgage twice. Some of them are finding that quite difficult.”

Non-federal lenders are not required by law to offer forbearance to homeowners in disaster zones, although they often do. Chu’s office said the bill would standardize the forbearance policies for federal lenders.

After the January fires, which destroyed more than 13,500 buildings in Altadena, Pacific Palisades and Malibu, more than 400 lenders offered homeowners a 90-day pause on mortgage payments without reporting the missed payments to credit agencies.

People who survived the fire, Chu said, “shouldn’t have to worry about missing a mortgage payment while they’re worrying about dealing with so many other things.”

The bill has 11 other co-sponsors, all Democrats, including Southern California Reps. Laura Friedman (D-Glendale), Jimmy Gomez (D-Los Angeles), Linda T. Sánchez (D-Whittier) and Lou Correa (D-Santa Ana), as well as several representatives from disaster-prone states, including Hawaii Rep. Jill Tokuda and Louisiana Rep. Cleo Fields.

No Republican lawmakers have signed on as original co-sponsors, but Chu and Sherman said they hope the bill will receive bipartisan support.

“This is the smallest thing they could do,” Sherman said. “This is virtually no cost to anyone.”

Chu said the bill was inspired in part by a story she read in the Pasadena Star-News reporting that as many as 3,200 survivors of the Eaton Fire and Palisades Fire missed mortgage payments after the January fires.

The story quoted a report by an insurance firm that found that on-time mortgage payments in the Palisades fire area fell 23.9% from December to February and 16.7% in the Eaton fire area. On-time payments rose 0.2% statewide over the same period.

Chu said the disaster bill is structured after the mortgage forbearance clause included in the CARES Act, the $2-trillion pandemic economic stimulus bill that passed Congress with bipartisan support and was signed into law by President Trump in March 2020.

The CARES Act required that lenders grant requests for forbearance on monthly mortgage payments for 180 days, with a possible extension of another 180 days.

Last month, Chu and Sherman also asked the Federal Housing Finance Agency, which regulates mortgage giants Fannie Mae and Freddie Mac, to allow mortgage lenders to grant forbearances of up to two years, in six-month increments, after natural disasters.

The current limit of one year, the lawmakers wrote, “does not account for the prolonged disruptions that homeowners face after a disaster of this magnitude. Allowing a longer period with fewer administrative hurdles would help prevent unnecessary foreclosures, preserve homeownership and support community resilience.”

Source link