-

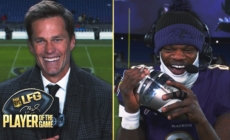

Tom Brady's LFG Player of the Game: Ravens' Lamar Jackson | Week 16 DIGITAL EXCLUSIVE - 27 mins ago

-

Alpha Prime Racing Confirms Huge Crew Chief Signing For NASCAR Xfinity Series - 37 mins ago

-

2 U.S. Navy pilots eject to safety after friendly fire downs their fighter jet - 42 mins ago

-

JuJu Watkins and No. 7 USC hold off Paige Bueckers and fourth-ranked UConn 72-70 - about 1 hour ago

-

Today’s ‘Wordle’ #1,282 Answers, Hints and Clues for Sunday, December 22 - about 1 hour ago

-

‘Connections’ December 22: Hints and Answers for Game #560 - 2 hours ago

-

No. 7 USC Trojans vs. No. 4 UConn Huskies | Paige Bueckers vs. JuJu Watkins thriller | FOX CBB - 2 hours ago

-

College Football Playoff: Ohio State Routs Tennessee, Will Face Oregon in Rose Bowl - 3 hours ago

-

Tom Brady picks his Super Bowl favorite a few weeks before NFL playoffs start - 3 hours ago

-

Dodgers Reportedly Battling With Blue Jays, Red Sox For Teoscar Hernández - 3 hours ago

How the second Trump administration could impact the housing market

Across Southern California, and for that matter much of the country, housing is unaffordable for many, whether someone is trying to buy a house or rent an apartment.

Voter concern over the nation’s cost of living, including housing, appears to have played a big role in returning Donald Trump to the White House.

Now, can he fix it?

During the campaign, the former president promised to bring down mortgage rates, cut costly red tape, open federal lands to development and deport millions of people in the country illegally — which the campaign said would lower costs by opening housing for citizens.

Interviews with economists and other housing experts paint a complicated picture of how that all could play out, with some warning that pieces of Trump’s agenda could make a bad situation worse, while others could help.

“It depends on what Trump does,” said Daryl Fairweather, chief economist with real estate brokerage Redfin.

One big question is mortgage rates.

Presidents do not set borrowing costs, though policies their administrations enact can influence the price of a loan.

When it comes to mortgages, interest rates are heavily influenced by the expectation for inflation. A growing federal deficit can also put upward pressure on rates.

Supply chain problems coming out of the pandemic, coupled with pandemic economic stimulus under both presidents Trump and Biden, have been blamed for contributing to the inflation surge in recent years, though the rate of cost increases has since ebbed to more normal levels.

Whether that slowing trend continues is unclear.

A preelection survey from the Wall Street Journal found most economists believed inflation and interest rates would be higher under policies proposed by Trump than Vice President Kamala Harris.

In particular, economists say the former and soon-to-be-again president’s stated plans for sweeping tariffs and tax cuts could reignite inflation and significantly raise the deficit, thus putting upward pressure on home loan costs.

“There definitively is a risk,” Fairweather said.

Ed Pinto, co-director of the Housing Center at the right-leaning American Enterprise Institute, said such fears may not come to pass.

He said he views tariffs mostly as a negotiating tactic and noted Trump has put forth other proposals that could reduce mortgage rates by decreasing inflation and deficits. These include lowering energy costs through more fossil fuel production and appointing the world’s richest man, Elon Musk, to slash government spending.

Another big component of housing is supply — the lack of which economists tend to single out as the main culprit driving rents and home prices higher.

Trump has called for cutting regulations that make it more difficult to build, but many of those rules are the domain of local authorities, giving the federal government limited options to change course, Fairweather said.

The former president has also called for building new homes on federal lands, which Pinto said could improve affordability in Western states like Utah and Nevada where the federal government owns large tracts of land and people fleeing California have pushed up prices.

Even within the Golden State, Pinto said there’s likely lots of federal land to build.

“This would be huge for the western third of the country,” Pinto said.

Others are more skeptical. In a report last week from banking giant UBS, analysts wrote that “the federal land initiative could be challenged by a lack of existing infrastructure in these generally rural areas.”

Immigration is another wild card. Trump has pledged to carry out the largest deportation of people here illegally that the country has ever seen.

As of 2022, there were an estimated 11 million undocumented immigrants in the U.S., and mass deportations would break up mixed-status families and could send shock waves through parts of the economy.

Richard Green, director of the USC Lusk Center for Real Estate, said that if Trump succeeds in carrying out mass deportations, it could lower housing costs somewhat in places like Los Angeles as hundreds of thousands of people are forced out and homes left vacant.

At the same time, Green noted, deportations could also push up rent and home prices because many undocumented immigrants work in construction building the homes that are needed to improve affordability.

There’s evidence this has happened before. A recent paper from researchers at the University of Utah and University of Wisconsin found that greater immigration enforcement led to less home building and higher home prices.

For now, both the Southern California for-sale and rental markets seem to be slowing down, but remain too expensive for most.

Last month, rent in L.A. County fell 1.7% from a year earlier, but is up 7.5% from October 2019, according to Apartment List. Home prices across Southern California have dipped for three straight months, but remain near their all-time highs, according to Zillow.

What happens next is difficult to know. The reason, according to Green? “It’s hard to say what Trump policies are actually going to happen.”

Source link